The credit score you receive is not the exact score. The verification service means RentPrep will check up to three references by phone. This includes SSN verification, address history, eviction report, judgments and liens, and bankruptcies.

Get 15% better eviction prediction than a typical credit score*

You can also order add-ons if needed. Deciding who pays for the tenant screening fee depends on which package you buy. If you purchase the RentPrep Background Check, you pay the screening fee. If you buy the SmartMove package, then you can choose to let the tenant pay. The method for obtaining the reports is as follows: You sign up for a free account, choose a package, order extras add-ons if needed, upload verification documents, and pay online.

RentPrep does not offer instant reports.

A RentPrep report typically takes about one to two business hours after the order. If you added verification calls, it could take 24 hours to complete the phone call verification during the business week. The SmartMove report makes the information available within minutes of the applicant verifying their identity, so the turnaround time depends on how long it takes the applicant to respond to verify their identity.

RentPrep charges extra for background check features nationwide criminal records and sex offender search , but they do offer reference checking by phone. Furthermore, the SmartMove screening price is more expensive than alternatives who offer the same screening reports for less.

CoreLogic MyRental offers a free rental application that applicants can fill out online. MyRental uses data from the credit bureaus, bankruptcy record, and payment history to determine the tenant score. Some packages include a full credit report, nationwide criminal records, and evictions history reports. You can specify which documents you would like the applicant to upload or submit via the MyRental platform.

The criteria by which we assessed these tenant screening services

MyRental does not check references. There are three MyRental plans to choose from. It does have an eviction and criminal background check. You decide who pays for the screening fee. The turnaround time depends on how quickly the applicant verifies their identity.

The method is as follows: When you want to screen applicants, you can fill in the info about the applicant on the MyRental platform and then submit it for screening. The applicant grants you access to their credit information and you receive the reports. TransUnion SmartMove does not provide a free online rental application that the applicant fills out. You can receive a TransUnion credit score and credit report. The credit score is also a credit-based ResidentScore which is based on a model that predicts rental industry outcomes.

You receive a nationwide criminal record report as well as eviction history report. SmartMove does not offer a document uploading feature nor reference checking.

Online Tenant Screening & Background Check

You can choose to pay for the screening fee or have your applicant pay for it. The turnaround time depends on the speed at which the applicant responds to authenticating their identity and granting access to their credit information.

The method to request reports is as follows: You create an account and send your applicant an invitation. The applicant receives the invite and completes the online application. TransUnion SmartMove does not offer a rental application, reference checks, or a document uploading option. Tenant screening services are available to both members and non-members. You can receive a full credit report and score depending on which package you purchase. The criminal background check can be purchased with some packages. Be careful when selecting a package because some only include criminal records history for one state rather than the whole United States.

The less expensive packages include only state-specific eviction history, and some do not include the eviction history at all. There are no document uploading and reference checking options with AAOA. You pay the screening fee, and the turnaround time is instant except for requests that include a credit report or score. The method to request reports is as follows: You provide AAOA with tenant information and pay for the package of reports you wish to purchase.

You receive the tenant screening reports in that package instantly except for the credit report because the applicant will need to grant you permission to view their credit report. AAOA emails the tenant a unique link so that they can verify their identity and release the credit report to you. AAOA emails you when the credit report is ready for viewing. AAOA charges extra to get nationwide eviction and criminal records. Most agents and landlords want to search records from all over the United States rather than from one specific state.

If a criminal background check is a critical feature for your tenant screening process, be prepared to incur additional expense to access such reports.

Tenant Background Check | Rental Credit Screening for Landlords

Also, there are no document uploading options, and they do not check references. All of these tenant screening services are upstanding, but some offer more than others. The more you know about these companies and their features, the more money you can save and put back into your business. Reducing your costs and liability is key in choosing the right tenant screening service. Home Best Tenant Screening Services Best Tenant Screening Services of Review and analysis of the 8 best tenant screening companies.

Last updated April 29, Landlords, real estate agents, and property managers can all benefit from the speed, accuracy, and efficiency of a tenant screening service. We used a 5-star rating system to measure and compare the best tenant screening services. Tenant screening services also look for things such as histories of late payments, bankruptcies, and any evictions or money owed to a previous landlord.

Tenant screening companies may not disclose any information about your history as a survivor of domestic violence, sexual assault or stalking. This includes information about a tenant having a protection order or previously breaking a lease because of domestic violence.

- Online Tenant Screening For Independent Landlords.

- shawnee county district court foreclosure records;

- camden county nj recorder of deeds;

It may be a good idea to talk to the landlord to get a sense of their standards before you apply. You may be able to avoid having to pay unnecessary screening fees if you find out ahead of time that the landlord will not consider renting to any tenant who has an eviction or criminal history. Landlords may be willing to discuss their specific criteria, which could save you from paying screening fees for a unit where the landlord will not be willing to rent to you because of a blemish on your record. There is a sample form of the adverse action notice both in RCW The prevailing party can also recover court costs and reasonable attorney fees.

If the landlord does not provide written notice, you may choose to inform the landlord of the new requirement to disclose the information detailed above. Speak to a Tenant Counselor or attorney for more information and assistance, or see our Legal Assistance Guide.

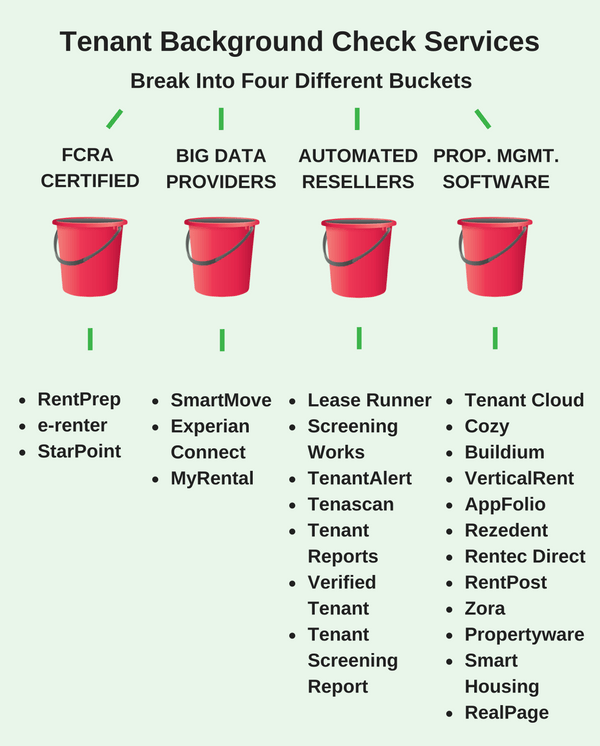

Tenant Screening Services

Credit is one of the primary issues that landlords consider when screening tenants. If you know that you have credit problems, or if you find yourself paying numerous costly credit check fees to apartment buildings, you can take a copy of your credit report to the landlord when you look at the apartment and show them any blemishes that appear. Landlords do not have to accept your copy of the credit report, but you can explain what happened to your credit and what you are doing to clear up the problem. You may be able to improve your credit by paying off any judgments or debts and making sure everything that appears on the report is correct.

It will take work to clean up your credit. There is no quick way to get rid of credit issues, but many landlords will be more willing to work with you if you have negotiated a payment plan to pay off back debts. Solid Ground offers Financial Fitness Boot Camp that may be helpful in getting back on your feet financially.

As of December , the Federal Fair Credit Reporting Act requires each of the three big credit reporting agencies to provide you with a free copy of your credit report, at your request, once every 12 months. It will cost a few dollars more if you would also like a credit score FICO score , in addition to your report. There are three major credit reporting agencies: Equifax, Experian and TransUnion.

These agencies have set up one central website, phone number, and address through which you can order your free annual report. Be careful of fake or fraudulent websites. To order a copy of your credit report, go to annualcreditreport. Keep in mind that each of the three credit reporting agencies above will have different information on you, so Equifax might show an account that Experian does not, for example. It all depends on whom your creditors use.

You might want to get all three, requesting a different one every few months so you have the complete picture. If the entire reason or part of the reason the landlord denied your tenancy is because of your credit report, they must tell you that they did so and provide you with the name, address and phone number of the credit reporting agency that provided that information to them.