Limited Liability Company. Sole Proprietorship. Professional Corporation. Professional LLC. Company Name Change. Sales Tax Registration. Certificate of Good Standing.

Annual report Filing. Company Dissolution. Retail Cigarette License. Trademark Registration. We will share a brief overview below to register business in the state of Connecticut, and what documents to be filed according to the entity type that has been chosen to start business in Connecticut. It's advised to stay connected with our live operators, who are available 7 days and 24 hours for your help. The state of Connecticut is one of the most efficient states that has a very effective electronic portal to file documents online. One of the most common questions to start a company in the state of Connecticut, What are the parameters to choose a right business type?

Corporation, limited liability company or if there is another alternative available which is a great fit for your business. Choose a right business type to lower taxes, veil personal assets and ability to raise capital if needed. Are you buying an existing business in Connecticut? Do you have to register with DRS? How much is the registration fee to open company in the state of Connecticut?

What is an estimated time to register a business and obtain licenses in the state of Connecticut? Rules and regulations of tax filings in Connecticut. Determine the legal structure of your business; such as registering a business name in Connecticut under your personal name or incorporate business name as an LLC or a Corporation which enables you to isolate or protect the personal assets from business.

- How to Start an LLC in Connecticut.

- Connecticut SOS Rules on Your LLC Business Name!

- Connecticut Tax Registration.

- Free Download!

It is very important to veil your personal assets with a right entity type and insurance. State of Connecticut does not file a duplicate business name, and rejects such application. Fill out a right application according the entity type, that you have chosen to transact business in the state of Connecticut, such as; a trade name, corporation or a limited liability company. Connecticut Secretary of State charges all filing fees before processing the order.

Connecticut Secretary of State Business Search and Registering Your LLC Name

For Example; A corporation has the ability to issue shares to the investors for raising the capital. An LLC is well suited to a single owner company, where an owner of a company simply reports, business income and loss on the Internal Revenue Form Winding Up. A record of the Connecticut Corporation is added to the list of Corporations which have officially registered with the Connecticut Secretary of State. Once a Corporation is registered with the Connecticut Secretary of State, that Corporation immediately has both reporting and tax obligations which incur penalties if the obligations are not met by the required deadlines.

If you've registered a Connecticut Corporation with the Connecticut Secretary of State and want to cease business activities you have to let the CT Secretary of State know that you intend to close your company. Only after the CT Secretary of State has made sure that all of the obligations of the Connecticut Corporation have been fulfilled will the Secretary of State approve of the closure of the company.

In addition, if there are any assets of the CT Corporation left after winding up the assets must have been distributed before the CT Secretary of State will approve the Dissolution of the Connecticut Corporation. If the Connecticut Corporation does not file reports or pay taxes then that CT Corporation could be responsible for penalties which go up as time goes by. What do I have to do to Dissolve a Connecticut Corporation? Connecticut Corporation Dissolution is one part of a larger process commonly called the "Winding Up" process.

There are things you need to do before you can request approval of Corporation Dissolution from the Connecticut Secretary of State; and things that you have to do after the CT Secretary of State has approved Dissolution of the Connecticut Corporation. What you have to do both before and after the Connecticut Corporation is Dissolved largely depends on how much stock, if any, has been issued and how much and what kind of debts and liabilities that the Connecticut Corporation has.

What to Know About Doing Business in Connecticut

Things you need to do before you Dissolve a Connecticut Corporation. Pay all taxes and administrative fees owed by the Connecticut Corporation more Minutes of the meeting must be recorded and retained in the business records. If the Board of Direcrtors has not been appointed then the Incorporator s have to apply for Dissolution of the Connecticut Corporation. We can transcribe and compile minutes or approvals into a form that is legally recognized by the Connecticut Secretary of State.

Hold a Shareholder meeting to approve Dissolution of the Connecticut Corporation. If a Connecticut Corporation has issued shares of stock then a majority of Corporate Shareholders must approve the Dissolution plan. The approval actions should be documented and kept in the business records. If no shares have been issued then the Connecticut Corporation Dissolution process is easier.

If necessary, we can transcribe and compile minutes into a form that is legally recognized by the Connecticut Secretary of State. Clear up any business debts. All creditors of a Connecticut Corporation should be given notice of the pending Corporation Dissolution. Each creditor should be given a mailing address to which they may submit claims as well as a deadline by which claims may be submitted. While the Connecticut Secretary of State does not legally require the publication of a Notice of Dissolution of a Connecticut Corporation, publication is a good way to notify anyone who might have a claim against the Connecticut Corporation.

We can prepare a Notice of Dissolution of the Connecticut Corporation, make sure it gets published and obtain evidence of publication. Pay all taxes and administrative fees owed by the Connecticut Corporation. The Connecticut Secretary of State will definitely not approve the Dissolution of a Connecticut Corporation until all outstanding taxes and applicable registration and administrative fees have been paid. Things you have to do after you Incorporate in Connecticut.

- white pages for middle river mn?

- How to Form an LLC in Connecticut.

- Starting a Business - EDC of New Haven & REX Development.

- find the location by ip?

- looking for magellan 750m portable vehicle gps system?

Distribute all remaining assets of the Connecticut Corporation. If the Connecticut Corporation has any remaining assets, these may be divided according to the Shareholders' ownership interests in the CT Corporation. Close all business bank accounts of the Connecticut Corporation. If there are any business accounts that have been opened for the Connecticut Corporation then those accounts must be closed. If Corporate business accounts are left open there may be liability and obligations of the Dissolved Connecticut Corporation which could lead to legal problems.

IRS Tax ID (EIN) Application

Cancel all local business licenses and permits of the CT Corporation. If the Connecticut Corporation has obtained any state, regional, county or city business licenses or permits, each of those must be cancelled to avoid any reporting or fiscal obligations of the Connecticut Corporation. This includes business registration licenses as well as reseller permits.

File IRS Form This filing is required within 30 days after the final Dissolution plan is approved.

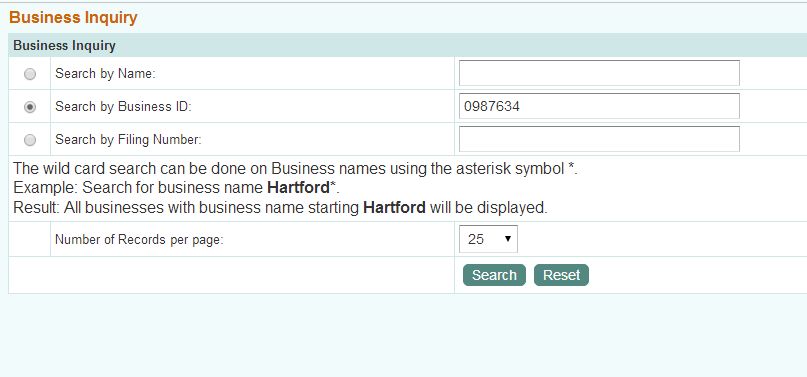

Corporation & Business Entity Search

We can prepare IRS Form for you to file. However, the account associated with the EIN is not automatically closed. The Connecticut Corporation must have filed all required tax returns and paid any applicable fees and penalties due to the IRS. We can prepare the formal documents which you can sign and submit to the IRS in order to close the account associated with your EIN. How long does it take to Dissolve a Connecticut Corporation? The time it takes to Dissolve a Connecticut Corporation varies depending on how long it takes to complete the actions that are required in each specific case - holding meetings, closing accounts, distributing assets, etc.

Once the initial actions are completed, the Connecticut Secretary of State usually takes around business days to process the Certificate of Dissolution. Processing times for Connecticut Corporation Dissolution filings vary depending on the work load of the Secretary of State's staff. We've found that normal processing of Connecticut Dissolution filings takes the state around business days.

We are dependent on, and have no control over, the staff and systems of the Connecticut Secretary of State.

In our experience business days is the time it usually takes the Connecticut Secretary of State to process a Connecticut Dissolution filing. Once it is at the state we have no control over the Connecticut Dissolution approval process. How much does it cost to Dissolve a Corporation in Connecticut? The total cost to Dissolve a Connecticut Corporation varies depending on exactly what is required for each specific CT Dissolution. If there are Foreign Corporations in states other than Connecticut that are tied to the Domestic Connecticut Corporation then each of those Foreign Corporations must be Dissolved before the Connecticut Corporation is legally Dissolved.

Can I revoke Dissolution after it is approved by Connecticut?

How to Form an LLC in Connecticut | Nolo

This subsection shall not apply to the use of A any trademark or service mark registered under the laws of this state or under federal law, B any such name that, when applied to the goods or services of such person's business, is merely descriptive of them, or C any such name that is merely a surname. A violation of the provisions of this subsection by a person conducting business under an assumed or fictitious name that includes the name of a municipality in this state shall be deemed an unfair or deceptive trade practice under subsection a of section b.

Nothing in this subsection shall be construed to impose any liability on any publisher that relies on the written assurances of a person placing such printed advertisement that such person has authority to use any such assumed or fictitious name. Sportsmen's Licenses. Fishing licenses are required for anyone 16 years old or older. Hunting and fishing guides are available when you purchase your license. Lost License. Liquor Licenses. Trade Name Certificates. All individuals authorized to sign on behalf of the business must appear before a Notary Public, Town Clerk or any other persons authorized by law to acknowledge your signature.