What is a corporate number?

Federal tax reform. Agencies under the United States Department of the Treasury. Outline of U. Courts of appeals District courts Supreme Court. Ages of consent Capital punishment Crime incarceration Criticism of government Discrimination affirmative action antisemitism intersex rights Islamophobia LGBT rights racism same-sex marriage Drug policy Energy policy Environmental movement Gun politics Health care abortion health insurance hunger obesity smoking Human rights Immigration illegal International rankings National security Mass surveillance Terrorism Separation of church and state.

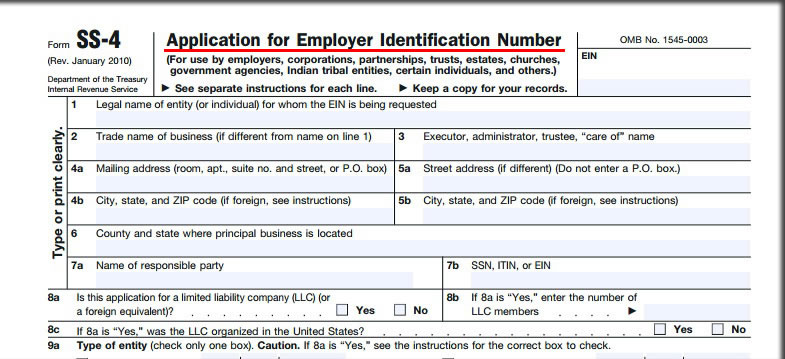

What Is a Business Tax ID Number?

Outline Index. Database management systems. Administration Query optimization Replication. Database models Database normalization Database storage Distributed database Federated database system Referential integrity Relational algebra Relational calculus Relational database Relational model Object-relational database Transaction processing.

- Newsletter.

- The U.S. Internal Revenue Service uses these numbers to:.

- Tax ID Numbers or FEIN?.

- Tax Identification Number (TIN) Definition - What is Tax Identification Number (TIN).

- state registration requirements for sex offenders.

Categories : Database management systems Taxation in the United States Unique identifiers Taxpayer identification numbers Company identification numbers. Hidden categories: Articles with short description. Namespaces Article Talk.

EIN Lookup: How to Find Your Business Tax ID Number

Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy. This article is part of a series on.

- When Will I Need My Company's EIN?.

- arizona rules of criminal procedure online.

- look up address by phone munber.

- Do You Really Need an EIN?.

United States portal. Share the number only with a limited subset of people—lenders, prospective suppliers, bankers, etc. Once you obtain an EIN for your business, that tax ID remains with your business for the entire lifespan of the company. However, there are some situations where you might need a new business tax ID number. But you should still report a business name change or location change to the IRS.

Even if you close down your business and never file a tax return, no other business will ever get the same number. If you ever decide to reopen your business, you can use the old number. Knowing your business tax ID number is important, but with all of the competing attention for a small business owner, you might forget or misplace your tax ID. Your business tax ID number is important for lots of business milestones. Give us a call. Type below and hit Enter To search.

EIN vs ITIN: What's the Difference and Who Needs Them?

Want the best small business strategies delivered straight to your inbox? About Latest Posts.

Priyanka Prakash is a senior staff writer at Fundera, specializing in small business finance, credit, law, and insurance. She has a law degree from the University of Washington and a bachelor's degree from U.

How to Find a Company's EIN | LegalZoom Legal Info

Berkeley in communications and political science. Priyanka's work has been featured in Inc. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup. Email: priyanka fundera. Editorial Note: Fundera exists to help you make better business decisions. The opinions, analyses, reviews, or recommendations in this article are those of our editorial team alone.

Our Picks. Leadership Advice. The 35 Best Books for Entrepreneurs.