If you are thinking of possibly renting out your home, check out our before you rent your home infographic. With our tenant screening services, you will be able to run credit checks and credit reports 24 hours a day, 7 days a week. Included with the tenant screening services is a credit recommendation Accept, Accept with additional deposit, Accept with a co-signor or Decline that can help you take the guesswork out of making crucial rental decisions.

As a client of You Check Credit, you will now have the ability to get fast, accurate tenant verification credit reports and background check information when you need it. The first step in protecting your rental property is doing thorough tenant screening checks of every applicant which starts with reviewing your applicants credit report. Cutting corners on your tenant screening could cost you thousands of dollars and countless headaches. With You Check Credit you will be able to perform online credit checks and make an instant informed decision based of your tenant's background. You Check Credit offers unsurpassed tenant screening services at a great price and our product line contains a wide variety of on-line background check reports to choose from when evaluating prospective residential tenants.

Request Password or User ID. This form may be used to change your new password or retrieve your user ID. Your information will be automatically emailed to you immediately.

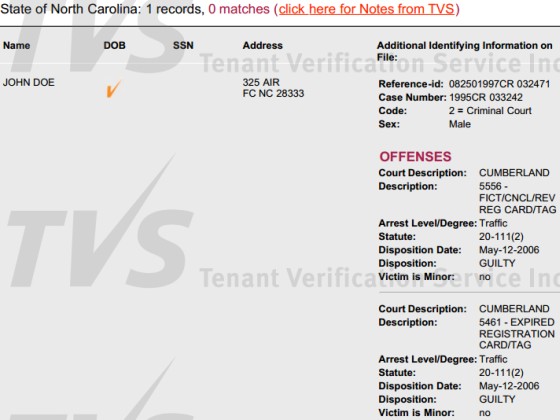

Management Companies. Individual Landlords. Most landlords pay tenant screening companies to research potential tenants, including criminal background checks, credit checks, eviction and court records, employment history and rental histories.

Tenant screening services also look for things such as histories of late payments, bankruptcies, and any evictions or money owed to a previous landlord. Tenant screening companies may not disclose any information about your history as a survivor of domestic violence, sexual assault or stalking. This includes information about a tenant having a protection order or previously breaking a lease because of domestic violence. It may be a good idea to talk to the landlord to get a sense of their standards before you apply. You may be able to avoid having to pay unnecessary screening fees if you find out ahead of time that the landlord will not consider renting to any tenant who has an eviction or criminal history.

Tenant Screening, Credit Reports and Background Checks. Free for Landlords - Cozy

Landlords may be willing to discuss their specific criteria, which could save you from paying screening fees for a unit where the landlord will not be willing to rent to you because of a blemish on your record. There is a sample form of the adverse action notice both in RCW The prevailing party can also recover court costs and reasonable attorney fees.

If the landlord does not provide written notice, you may choose to inform the landlord of the new requirement to disclose the information detailed above. Speak to a Tenant Counselor or attorney for more information and assistance, or see our Legal Assistance Guide. Credit is one of the primary issues that landlords consider when screening tenants. If you know that you have credit problems, or if you find yourself paying numerous costly credit check fees to apartment buildings, you can take a copy of your credit report to the landlord when you look at the apartment and show them any blemishes that appear.

Landlords do not have to accept your copy of the credit report, but you can explain what happened to your credit and what you are doing to clear up the problem. You may be able to improve your credit by paying off any judgments or debts and making sure everything that appears on the report is correct. It will take work to clean up your credit. There is no quick way to get rid of credit issues, but many landlords will be more willing to work with you if you have negotiated a payment plan to pay off back debts. Solid Ground offers Financial Fitness Boot Camp that may be helpful in getting back on your feet financially.

Tenant Services

As of December , the Federal Fair Credit Reporting Act requires each of the three big credit reporting agencies to provide you with a free copy of your credit report, at your request, once every 12 months. It will cost a few dollars more if you would also like a credit score FICO score , in addition to your report. There are three major credit reporting agencies: Equifax, Experian and TransUnion. These agencies have set up one central website, phone number, and address through which you can order your free annual report.

Be careful of fake or fraudulent websites. To order a copy of your credit report, go to annualcreditreport. Keep in mind that each of the three credit reporting agencies above will have different information on you, so Equifax might show an account that Experian does not, for example. It all depends on whom your creditors use. You might want to get all three, requesting a different one every few months so you have the complete picture.

If the entire reason or part of the reason the landlord denied your tenancy is because of your credit report, they must tell you that they did so and provide you with the name, address and phone number of the credit reporting agency that provided that information to them. In turn, that credit reporting agency must provide you with a free copy of your credit report. Typically, in order to obtain the free report you must make the request within 30 days.

Tenant Screening

Potential landlords may research your rental history and seek references from previous landlords to get a sense of your qualifications as a renter. There are no laws in the Landlord-Tenant Act that restrict what information about you a landlord gives as a part of the screening process. You may decide to bring references from former landlords or employers and other character references. If you are concerned that a former landlord may misrepresent or lie about your qualifications as a tenant, you can give the new landlord an explanation of the situation or additional references.

Do you have an eviction on your record? Unfortunately, even if you never went to court, if a landlord ever filed a lawsuit to evict you, it will show up on your record. It is often best to be upfront about this with a potential landlord. You can explain the circumstances and ask if they are willing to rent to tenants with past evictions on their records.

Additionally, make sure that any judgments against you have been paid. If you were evicted illegally, or won in eviction court, it will still show up in your record as an eviction and can be used against you in the screening process. You can bring a written explanation or a letter from the court stating that you won the eviction, or that the action was brought against you illegally. The new landlord may be willing to consider the extenuating circumstances surrounding the eviction. The Tenants Union is working to win stronger protections for tenants who are evicted illegally or who win in eviction court.

For more information, see Fair Tenant Screening Act.

Some landlords may screen out tenants who have criminal records, assuming that they will not be trustworthy renters, regardless of the nature of the crime, the circumstances surrounding the conviction, and the amount of time that has passed since the criminal activity occurred. If you have a criminal record, you might want to be upfront about it in order to avoid paying screening costs for a unit where the landlord refuses to accept tenants with criminal records. If you can get a personal letter of reference from a community member, case manager or even a friend, bring that along.

You can ask the landlord if they will rent to someone with a criminal record. If you know right away that the landlord will not consider you for tenancy because of a criminal history or eviction on your record, you can save the money you would have spent on a tenant screening or application fee and apply for another unit. In some cases you may be able to expunge your record so it does not show up anymore. An arrest alone should not be grounds for denial of housing.

- Landlord Credit Checks | Background Screening - ApplyConnect;

- Get 15% better eviction prediction than a typical credit score*?

- Commercial Services?

- What To Know Before Reviewing Tenant Screening Services?

- pasco county home sales public record.

If you were denied housing because of previous criminal charge for which you were not convicted, that could be a violation of fair housing laws. A criminal charge is not a determination of fault under the law and may be reported to a Civil Rights Office. In addition, it is discrimination for a landlord to only run criminal background checks on protected class groups, or not to select applicants consistently based on the same criteria. It also may be discrimination for landlords to have outright bans on all people with criminal records, because it disparately impacts groups that are incarcerated more heavily for discriminatory reasons.

Tenants whose criminal history is related to a disability can make a reasonable accommodation request to the landlord to accept alternative forms of determining eligibility for housing.

Experian Global Sites

Past drug addiction is considered a disability under fair housing laws. The tenant may submit a plan to the prospective landlord detailing any and all efforts they have undertaken to address and eliminate the issues that led to the crime, in addition to letters of support or certificates from drug rehabilitation programs, case managers, or other landlords. The ACLU may also be able to offer assistance.

In addition, the City of Seattle is currently considering a proposal to make it illegal for housing providers to discriminate against tenants on the basis of arrest or conviction record history.