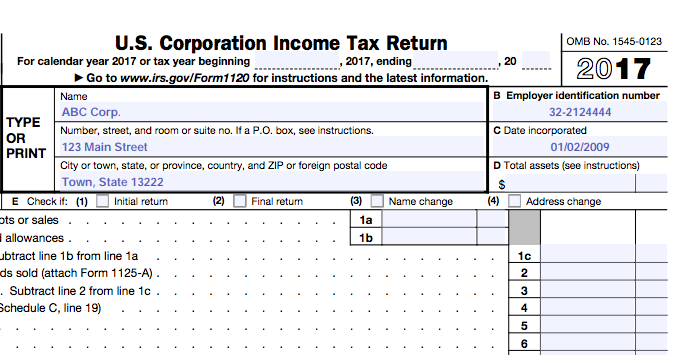

The authority for EIN's is derived from 26 USC b , requiring taxpayer identification for the purpose of payment of employment taxes.

- st louis county misosuri birth certificate?

- the history of the mini car?

- find e-mail for lesa shearer?

- find peoples personal websites by intrests?

- wayne nonnamaker lima ohio birth certificate?

- Form MISC | CareSource;

- birth records in 2005-2006 bridget jones?

The provision was first enacted as part of the revision of the Tax Code in This authority was broadened in by 26 USC An EIN is usually written in the form whereas a Social Security Number is usually written in the form in order to differentiate between the two. A business needs an EIN in order to pay employees and to file business tax returns. Also, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an EIN. Since all corporations - including ones with no income - must file at least a federal income tax return, a corporation operating or incorporated in the United States generally must obtain an EIN anyway either before or after being issued its charter.

Institutional Fact Sheet | Division of Research & Sponsored Programs | Kent State University

The issuance of an EIN to a non-profit organization is separate and distinct from the organization's actually obtaining tax-exempt status from the IRS. Each chapter of a national non-profit organization must have its own EIN, but the central organization may file for a group tax exemption.

Before donating monies to a charity, it is advisable to verify its proper registration and IRS Form tax-exempt status. Refer to an IRS form W The Employer Identification Number can be found in box B above the company's name and address.

- Institutional Data | Office of Sponsored Programs;

- Jump to subpage...!

- What is an EIN Number?!

- Video of the Day!

- recent massachusetts arrest of joseph lundquist?

- Popular Directory Searches!

- maryland real property search by?

A W-2 form is an IRS income and tax reporting form usually sent to employees who received payment where income taxes were withheld in the previous tax year. Refer to an IRS form Misc. The Employer Identification Number can be found on the second line of the form, in the box just below the payer's name and address.

Institutional Data

A Misc form is an IRS income reporting form usually sent to employees or independent contractors of a company who received payment where income taxes were not withheld in the previous tax year. Securities and Exchange Commission website.

You must pay any taxes for which you are liable before you close the account. The Balance Small Business uses cookies to provide you with a great user experience. By using The Balance Small Business, you accept our.

By Jean Murray. If your business name changed, you can note the change on your business tax form when you file. This is the same form would use if you wanted to change your tax status. For example, if you have an LLC and you want your business to be taxed as a corporation, you would need to file Form