The average homeowner in St. Across the Mississippi river from St.

Parcel Information Look-Up | McLean County, IL - Official Website

The average effective property tax rate in Madison County is 2. Champaign County contains the sister cities of Champaign and Urbana, as well as the campus of the University of Illinois at Champaign-Urbana. The city of Champaign has a listed tax rate of about 8. Zoom between states and the national map to see the counties getting the biggest bang for their property tax buck.

Our study aims to find the places in the United States where people are getting the most for their property tax dollars. To do this we looked at school rankings, crime rates and property taxes for every county. We created an average score for each district by looking at the scores for every school in that district, weighting it to account for the number of students in each school. Within each state, we assigned every county a score between 1 and 10 with 10 being the best based on the average scores of the districts in each county. Using the school and crime numbers, we calculated a community score.

This is the ratio of the school rank to the combined crime rate per , residents. We used the number of households, median home value and average property tax rate to calculate a per capita property tax collected for each county. Finally, we calculated a tax value by creating a ratio of the community score to the per capita property tax paid. This shows us the counties in the country where people are getting the most bang for their buck, or where their property tax dollars are going the furthest.

What is an Index Fund? How Does the Stock Market Work? What are Bonds? Investing Advice What is a Fiduciary?

- iowa law - home ownership in divorce!

- Property Tax.

- Aaron Ammons!

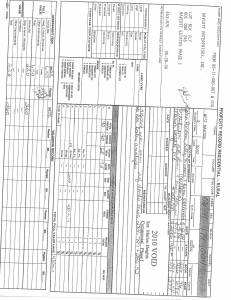

- Property Owners, Parcel Numbers & Assessed Values!

- Cook County Property Tax Portal.

- what is a police background check!

- Assessment | Jackson County, IL.

What is a CFP? Your Details Done. Overview of Illinois Taxes The state of Illinois has the second highest property taxes in the country. As a result, the monthly mortgage payment will not change. With an adjustable-rate mortgage the interest rate changes, generally on an annual basis, as the market interest rate changes.

Parcel Information Look-Up

Often structured to have a steady monthly payment for a specified period of time before adjusting. Based on a mortgage. View personalized rates. Searching for Mortgages Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers our 'Advertisers'.

Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria.

- County Assessment Links!

- Cook County’s Residential Property Tax Assessments Deeply Unfair, Independent Study Confirms.

- marriage counselors in michigan that take aetna insurance!

- Utility Menu!

- Champaign County Clerk.

In the above table, an Advertiser listing can be identified and distinguished from other listings because it includes a 'Next' button that can be used to click-through to the Advertiser's own website or a phone number for the Advertiser. Availability of Advertised Terms: Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program.

Click here for rate criteria by loan product. Loan Terms for Bankrate. To receive the Bankrate.

Search Disclaimer

This will typically be done by phone so you should look for the Advertiser's phone number when you click-through to their website. In addition, credit unions may require membership. You should confirm your terms with the lender for your requested loan amount. Your monthly payment amount will be greater if taxes and insurance premiums are included.

Consumer Satisfaction: If you have used Bankrate. Please click here to provide your comments to Bankrate Quality Control. View more mortgages. No mortgages were found. About This Answer. Our Tax Expert.

How helpful was this page in answering your question? We are working hard to improve our product and could use your help! How Property Taxes in Illinois Work Property tax assessments and collections in Illinois run on a roughly two-year cycle. Property Tax Exemptions in Illinois There are a number of exemptions that can reduce assessed value and therefore property tax payments in Illinois. Illinois Property Tax Rates Specific tax rates in Illinois are determined based on the total tax base, or the total value of property with a district. Show Show Show Show Show Methodology Our study aims to find the places in the United States where people are getting the most for their property tax dollars.

For each county, we calculated the violent and property crimes per , residents. OK Cancel. An error occurred Please reload the page. Sullivan, a resident of Batavia, was first appointed to the Board of Review in He is an Illinois state certified real estate appraiser. The appointment is for a full two-year term. Constantine "Dino" Konstans is an attorney and real estate broker from St.

Michael E. Madziarek to a new two-year term on the Board of Review. Madziarek, a resident of Gilberts, was first appointed to the Board of Review in On August 14, Chairman Lauzen made the following appointments: Ms. Michelle Abel, a state certified real estate appraiser from Aurora; Mr. James R. Clayton, a state certified real estate appraiser from Geneva; Mr.

Gerald A. Jones, a former full Board of Review member from Aurora; Ms. Sherry Melze, a state certified real estate appraiser from East Dundee; Mr. Kevin J. These members will serve until the Board of Review certified the assessment roll to the Kane County Clerk. The final filing deadline for property in Blackberry Township has been set for September 16,