The state then holds the property as custodian until the real owner can claim the property.

Find what's owed to you; unclaimed property event Saturday

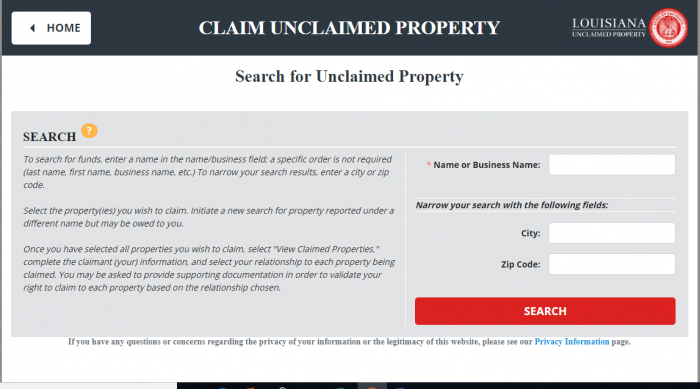

People can look for their property in the database or contact the State Treasury at If you live in Louisiana or have recently moved from Louisiana, we suggest you begin your unclaimed property search in the state. However, do not make the mistake that some people make and assume that searching your state database is enough for a comprehensive property search. It is important to realize that not all money reverts to the custody of the state, even after statutory periods of time.

This is particularly true for property that is originally held by federal government agencies like the U.

- robert burton mo birth records;

- About the Secretary.

- Administration | Louisiana State Treasurer | Louisiana!

Treasury or the IRS. It is also true for property where the location of the owner may not be determined, such as life insurance benefits. This means that you may open an account while living in one state, have a last known address in another state, and then be residing in a third state. As a result, you may need to look in multiple states to find all of your unclaimed property. Before the development of statewide unclaimed property databases, you had to search at an individual county level to find that unclaimed property. In Louisiana, the local divisions known as counties in other states are known as parishes.

Bernard, St. Charles, St. Helena, St.

- Unclaimed Money in Other States.

- webfetchgo com shopping search big brother;

- pasco county home sales public record;

- Office of the New York State Comptroller - Unclaimed Funds!

James, St. John the Baptist, St.

Connect with us!

Landry, St. Martin, St. Mary, St. You can specifically search by parish, as well as running a search for the entire state. While the definition of unclaimed property is similar from state-to-state, each state does define it in their statutes. The State of Louisiana defines unclaimed property as various types of abandoned financial assets, not including real estate or vehicles. Examples of unclaimed property include: checking and savings accounts, securities, uncashed checks, unpaid wages, and life insurance payouts.

It also includes property in safe deposit boxes, but the contents of the safe deposit boxes may be sold and the state will hold the proceeds for the owner. The property is considered unclaimed if, after a certain period of time, the owner has not made contact with the property holder and the holder has been unable to reach the owner. If the owner establishes contact with the owner through an online login, written correspondence, updating personal information, withdrawals, or deposits. While Louisiana, like most other states, lets you run a search by last-name only, doing so is not necessarily your best option.

That is because it may return so many results that your search is practically useless. You will see that this search returned unclaimed properties, but those results are actually inaccurate; the program will only return results at a time, so there may actually be many more results with the name Smith:. You are not limited to only entering a last name, so you can include other parameters to help limit the search results.

However, you will see that the results that have both Bob and Smith in them are included at the top. You will want to check for all of those names rather than rely on the top results for the full name search:. An even better way to narrow down the search results is to include the city or zip code that was in the address at the time.

We tried looking for Bob Smith in New Orleans, but did not get any exact matches:. After you have run the search you want and found some possible results, you can begin the claim process. As you can see in the above results, to the left of each record is a red claim button. Once you hit the claim button, it will look like this, and instead of a claim option you will be given a remove option if you do not want to include it in your results:.

- copy of birth certificate il;

- State of Michigan.

- yellowstone county mt clerk and recorder;

- marriage divorce rates in texas;

As you can see, there is a button you can push if you want to view claimed properties. It is located at the top and the bottom of the search page. If you choose to view claimed properties, you will be taken to a property that looks like this:.

Free money?! How to find and claim your family's unclaimed funds

This screen provides an overview of the property. You will also notice a box marked claimant relationship, which has a drop down box. You are asked to pick your relationship to the claimant. The options are: owner, estate representative, heir, business representative:. After you make your selection, you are taken to an additional screen.

For our example, we selected owner, and hit the File Claim button on the page, to get to this screen:. This contact screen asks you for information that the state needs to help you process your claim.

That information includes: claimant type, last name, first name, middle name is optional , date of birth, email address, home phone, other phone is optional , social security number or tax ID number, country, address, city, state, zip code, and how you heard about them. Once you fill out the contact sheet, the state lets you know what type of documentation you may need to provide to prove your identity or prove ownership of the property.

After you have submitted your claim, you need to collect any supporting documents that you were told to gather.

Georgia Unclaimed Property

For each claim, in addition to the original signed and notarized claim form, you will need a copy of your photo identification and proof of your social security number. You may also need to provide additional documentation:. Louisiana will hold unclaimed money for the original owner, or their heirs, until the property is claimed. Supplemental Secured Property Tax Bill An additional property tax bill issued as a result of the reassessment of the value of a property upon a change in ownership or completion of new construction.

Supplemental Tax Estimator A tool to estimate the expected amount of Supplemental Secured Property Taxes on a recent purchase of property. Taxable Event An event that requires the Office of the Assessor to assess or reassess the value of a property e. Taxing agency A local agency within a specific tax rate area e.

TDD Equipment A telecommunication device such as a teleprinter that is designed for people who have hearing or speech difficulties. We only accept U. Before you click the button, check the bank routing number and the bank account number to make sure you have entered each correctly. If either or both numbers are wrong our bank or your bank may not honor the electronic payment and return it to us unpaid. To avoid penalties, costs, and a returned transaction fee, please double-check the data before submitting the payment.

An identifying number assigned to the taxpayers for the annual, supplemental, and escape assessment taxes. The bill number is on the tax bill. The year the taxes are added to the tax roll.

La. Treasury Dept. looks to return $856M in 'Unclaimed Property'

Two years of tax information is available on the web site from approximately March thru June 30 of each year. Otherwise, the payment is delinquent and penalties will be imposed in accordance with State law. If the 1st installment is delinquent, a 10 percent penalty is imposed. The postmark is generally applied, either by machine or by hand, with cancellation bars and is primarily used to prevent postage from being re-used. Taxpayers who send their payments by mail are cautioned that the USPS only postmarks certain mail depending on the type of postage used.

Additionally, the USPS may not postmark mail on the same day it is deposited by a taxpayer. If you use these types of postage, the USPS will not postmark your mail. The PVI is applied to a piece of mail by personnel at the retail counter or window when postage has been paid to mail that item. The item is retained in USPS custody and is not handed back to the customer.

The date printed on the PVI label is the date of mailing. Electronic payments can be made 24 hours a day, 7 days a week and payments are accepted until p. Pacific Time on the delinquency date.